As we begin another year, everyone wants to know: “Where is the housing market headed in 2019?”

It’s not only buyers, sellers, and homeowners who are impacted. The real estate market plays an integral role in the overall U.S. economy. Fortunately, key indicators point toward a stable housing market in 2019 with signs of modest growth. However, shifting conditions could impact you if you plan to buy, sell, or refinance this year.

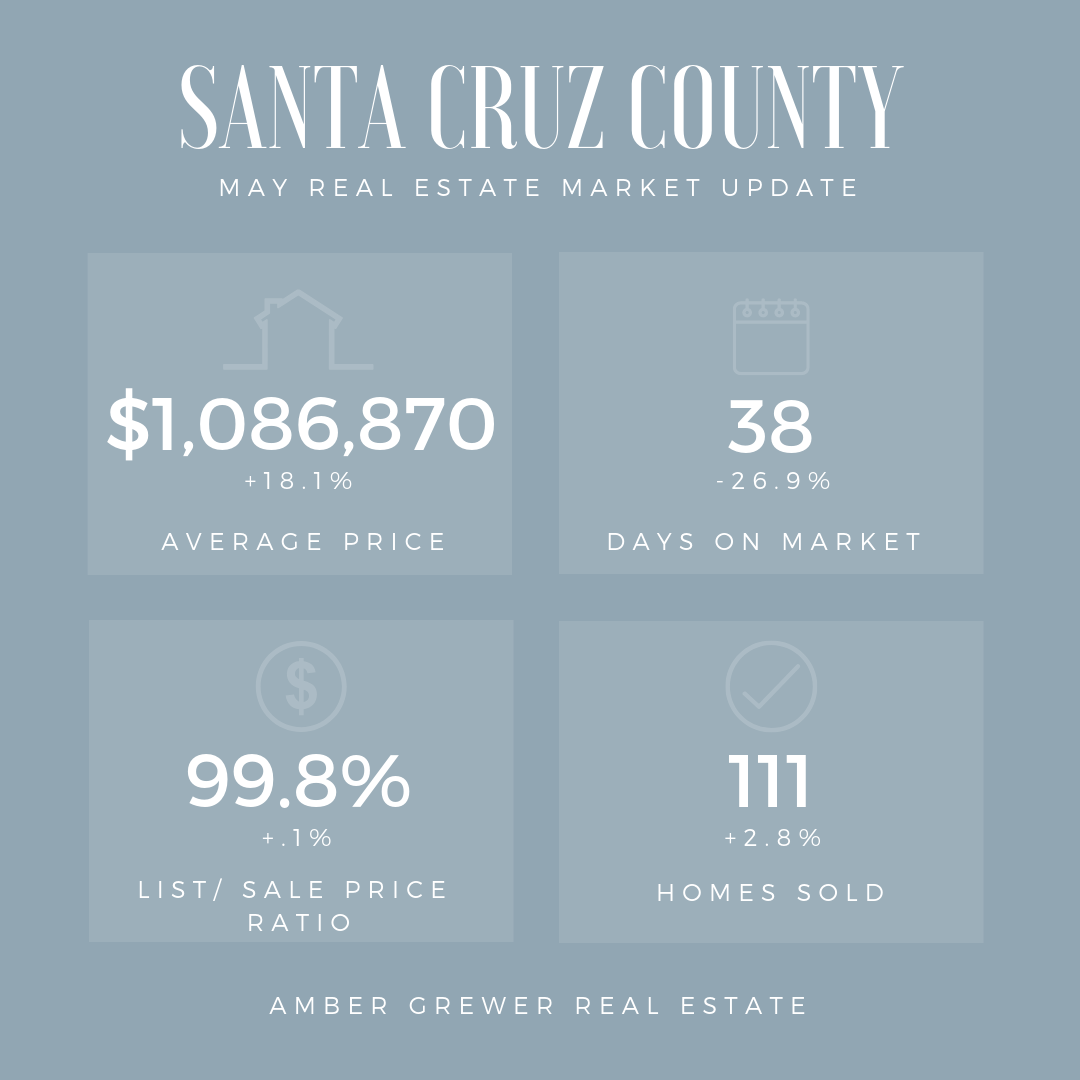

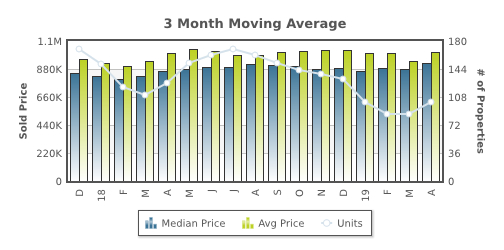

HOME VALUES WILL INCREASE

The value of real estate will continue to rise. Freddie Mac predicts housing prices will increase by 4.3 percent in 2019.1 While the rapid price appreciation we witnessed earlier in the decade has slowed, the combination of a strong economy, low unemployment, and a lack of inventory in many market segments continues to push prices higher.

“Ninety percent of markets are experiencing price gains while very few are experiencing consistent price declines,” according to National Association of Realtors (NAR) Chief Economist Lawrence Yun.2

Yun predicts that the national median existing-home price will increase to around $266,800 in 2019 and $274,000 in 2020. “Home price appreciation will slow down—the days of easy price gains are coming to an end—but prices will continue to rise.”

What does it mean for you? If you’re in the market to buy a home, act fast. Prices will continue to go up, so you’ll pay more the longer you wait. If you’re a current homeowner, real estate has proven once again to be a solid investment over the long term. In fact, the equity level of American homeowners reached an all-time high in 2018, topping $6 trillion.3

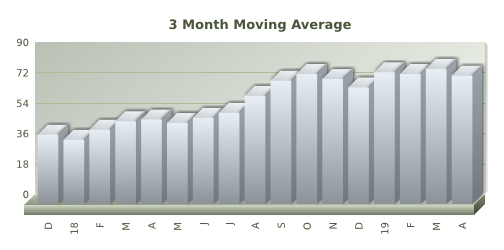

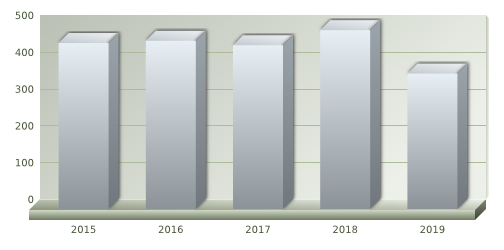

SALES LEVELS WILL STABILIZE

In 2018, we saw a decline in sales, primarily driven by rising mortgage rates and a lack of affordable inventory. However, Yun isn’t alarmed. “2017 was the best year for home sales in ten years, and 2018 is only down 1.5 percent year to date. Statistically, it is a mild twinge in the data and a very mild adjustment compared to the long-term growth we’ve been experiencing over the past few years.”2

Yun and other economists expect home sales to remain relatively flat over the next couple of years. Freddie Mac forecasts homes sales will increase 1 percent to 6.08 million in 2019 and 2 percent to 6.20 million in 2020.1

“The medium and long-term prospects for housing are good because demographics are going to continue to support demand,” explains Tendayi Kapfidze, chief economist for LendingTree. “With a slower price appreciation, incomes have an opportunity to catch up. With slower sales, inventory has an opportunity to normalize. A slowdown in 2019 creates a healthier housing market going forward.”4

What does it mean for you? If you’ve been scared off by reports of a market slowdown, it’s important to keep things in perspective. A cooldown can prevent a hot market from becoming overheated. A gradual and sustainable pace of growth is preferable for long-term economic stability.

MORTGAGE RATES WILL RISE

The Mortgage Bankers Association predicts the Federal Reserve will raise interest rates three times this year, resulting in a rise in mortgage rates.5 While no one can predict future mortgage rates with certainty, Realtor.com Chief Economist Danielle Hale estimates that the rate for a 30-year mortgage will reach 5.5 percent by the end of 2019, up from around 4.62 percent at the end of 2018.6

While mortgage rates above 5 percent may seem high to today’s buyers, it’s not out of line with historical standards. According to Hale, “The average mortgage rate in the 1990s was 8.1 percent, and rates didn’t fall below 5 percent until 2009. So for buyers who can make the math work, buying a home is likely still an investment worth making.”7

What does it mean for you? If you’re in the market to buy a house or refinance an existing mortgage, you may want to act quickly before mortgage rates rise. To qualify for the lowest rate available, take steps to improve your credit score, pay down existing debt, and save up for a larger down payment.

AFFORDABILITY ISSUES WILL PERSIST

Although the desire to own a home remains strong, the combination of higher home prices and rising mortgage rates will make it increasingly difficult for many first-time buyers to afford one.

“Buyers who are able to stay in the market will find less competition as more buyers are priced out but feel an increased sense of urgency to close before it gets even more expensive,” according to Hale. “Although the number of homes for sale is increasing, which is an improvement for buyers, the majority of new inventory is focused in the mid-to-higher-end price tier, not entry-level.”6

What does it mean for you? Unfortunately, market factors make it difficult for many first-time buyers to afford a home. However, as move-up buyers take advantage of new high-end inventory, we could see an increase in starter homes hitting the market.

MILLENNIALS WILL MAKE UP LARGEST SEGMENT OF BUYERS

“The housing market in 2019 will be characterized by continued rising mortgage rates and surging millennial demand,” according to Odeta Kushi, senior economist for First American. “Rising rates, by making housing less affordable, will likely deter certain potential homebuyers from the market. On the other hand, the largest cohort of millennials will be turning 29 next year, entering peak household formation and home-buying age, and contributing to the increase in first-time buyer demand.”4

Danielle Hale, chief economist for Realtor.com, predicts the trend will continue. “Millennials are also likely to make up the largest share of home buyers for the next decade as their housing needs adjust over time.”6

What does it mean for you? If you’re in the market for a starter home, prepare to compete for the best listings. And if you plan to sell a home in 2019, be sure to work with an agent who knows how to reach millennial buyers by utilizing the latest online marketing techniques.

I’m HERE TO GUIDE YOU

While national real estate numbers and predictions can provide a “big picture” outlook for the year, real estate is local. And as local market experts, we can guide you through the ins and outs of our market and the local issues that are likely to drive home values in your particular neighborhood.

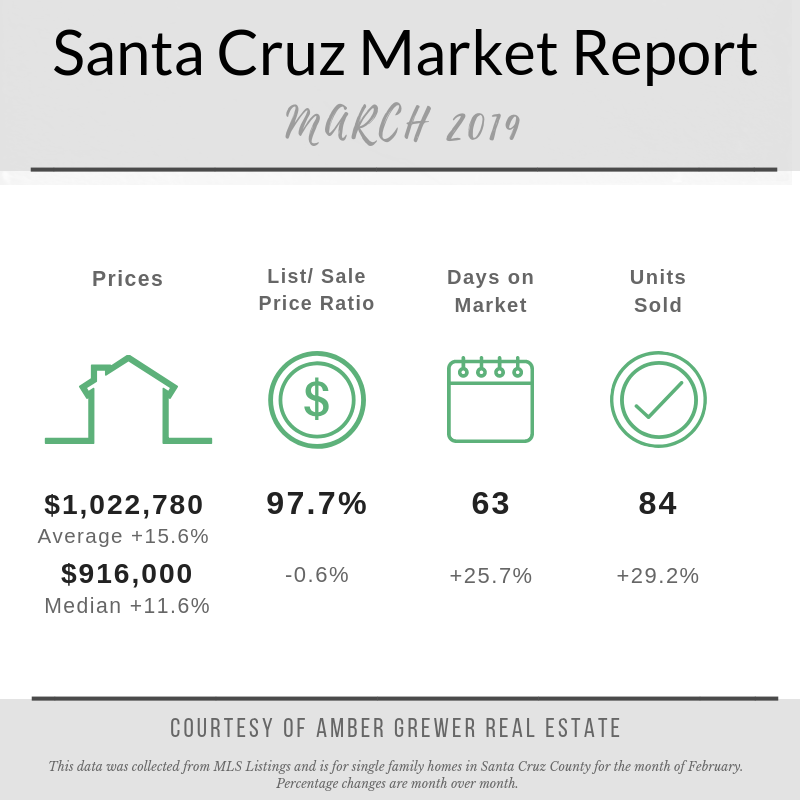

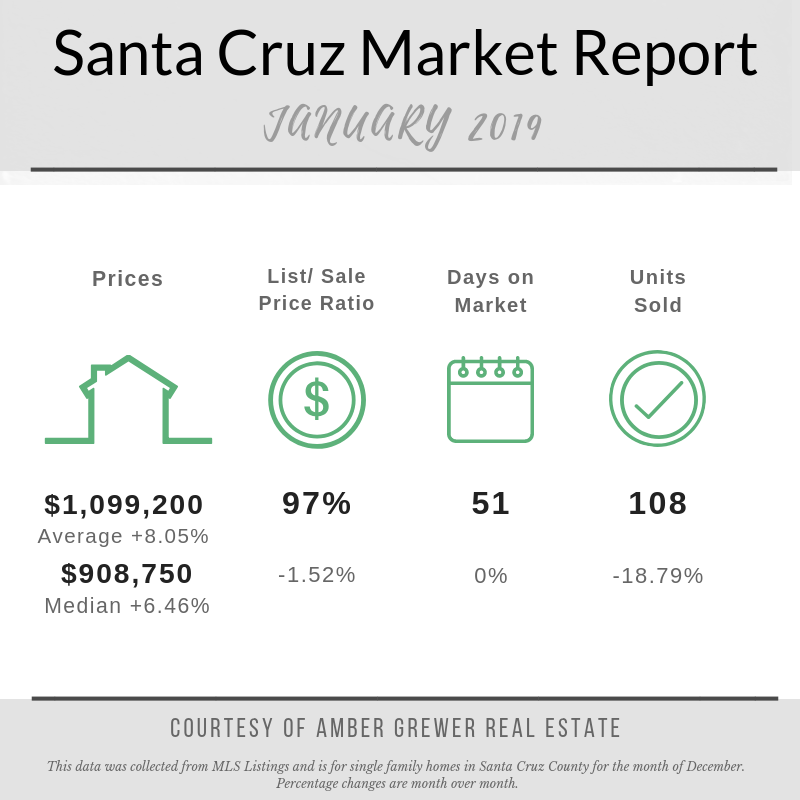

If you would like to subscribe to my specialized local monthly market update visit: http://ambergrewer.rereport.com/market_reportshttp://ambergrewer.rereport.com/market_reports

*Click “Subscribe to Report” in the upper right hand corner

If you’re considering buying or selling a home in 2019, contact us now to schedule a free consultation. We’ll work with you to develop an action plan to meet your real estate goals this year.

START PREPARING TODAY

If you plan to BUY this year:

- Get pre-approved for a mortgage. If you plan to finance part of your home purchase, getting pre-approved for a mortgage will give you a jump-start on the paperwork and provide an advantage over other buyers in a competitive market. The added bonus: you will find out how much you can afford to borrow and budget accordingly.

- Create your wish list. How many bedrooms and bathrooms do you need? How far are you willing to commute to work? What’s most important to you in a home? We can set up a customized search that meets your criteria to help you find the perfect home for you.

- Come to our office. The buying process can be tricky. We’d love to guide you through it. We can help you find a home that fits your needs and budget, all at no cost to you. Give us a call to schedule an appointment today!

If you plan to SELL this year:

Call us for a FREE Comparative Market Analysis. A CMA not only gives you the current market value of your home, it will also show how your home compares to others in the area. This will help us determine which repairs and upgrades may be required to get top dollar for your property, and it will help us price your home correctly once you’re ready to list.

- Prep your home for the market. Most buyers want a home they can move into right away, without having to make extensive repairs and upgrades. We can help you determine which ones are worth the time and expense to deliver maximum results.

- Start decluttering. Help your buyers see themselves in your home by packing up personal items and things you don’t use regularly and storing them in an attic or storage locker. This will make your home appear larger, make it easier to stage … and get you one step closer to moving when the time comes!

|

Sources:

- Freddie Mac Economic & Housing Research Forecast –

http://www.freddiemac.com/research/pdf/201811-Forecast-04.pdf

- National Association of Realtors 2019 Forecast –

https://www.nar.realtor/newsroom/2019-forecast-existing-home-sales-to-stabilize-and-price-growth-to-continue

- Bankrate 2018 Year in Review –

https://www.bankrate.com/mortgages/year-in-review-for-housing-market/’

- Forbes 2019 Real Estate Forecast –

https://www.forbes.com/sites/alyyale/2018/12/06/2019-real-estate-forecast-what-home-buyers-sellers-and-investors-can-expect/#a98b80a70d9a

- Mortgage Bankers Association Forecast –

https://www.mba.org/2018-press-releases/october/mba-forecast-purchase-originations-to-increase-to-12-trillion-in-2019

- com 2019 National Housing Forecast –

https://www.realtor.com/research/2019-national-housing-forecast/

- FOX Business –

https://www.foxbusiness.com/personal-finance/where-mortgage-rates-are-headed-in-2019

1,938 total views, no views today